The Price the Product Costs After Processing Is the

This is the final cost of your animal becoming single cuts of meat. There are two basic methods of pricing your products and services.

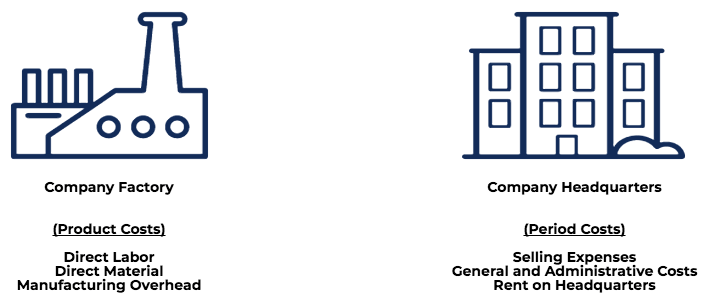

Product Costs Types Of Costs Examples Materials Labor Overhead

The joint process costs total 200000.

. The cost to manufacture a product might include the cost of raw materials used. This takes the cost of producing your product or service and adds an amount that you need to make a profit. The first step when calculating the cost involved in making a product is to determine the fixed costs.

Product B can be sold for 600000 after additional processing of 200000. A sale price of 611 per pound would give you a 25 return on your product. What youre looking for.

Able to sell its other nonreimbursed products at lower prices C the FASB requires the business to participate in the cost allocation process D Both A and B are correct. Candy type Number of pounds Price per pound at split-off Further processing costs Price after processing further Sweet Meats 50000 8 75000 1000. The number of units produced the selling prices per unit of the three products at the split-off point and after further processing and the additional processing costs are as follow.

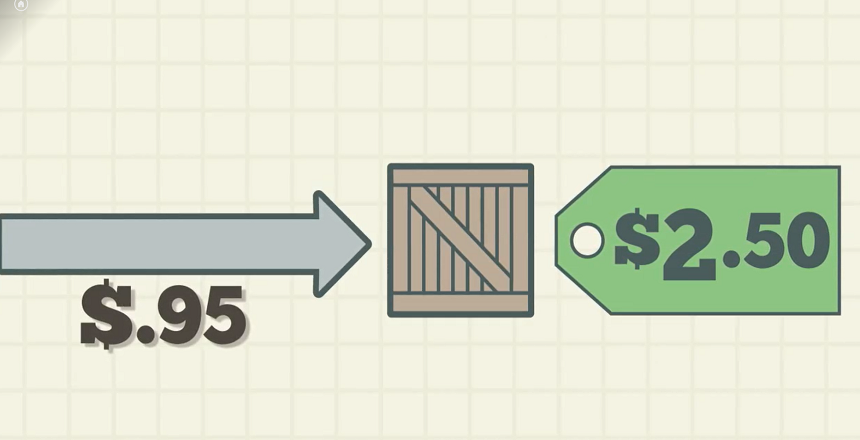

Convert the markup percent into a decimal. Sell-or-process decisions involving joint products should only consider costs after the split-off point ie. So you lose money when your weight times the product weight of the product you process times the price is less than your cost of goods and your overhead.

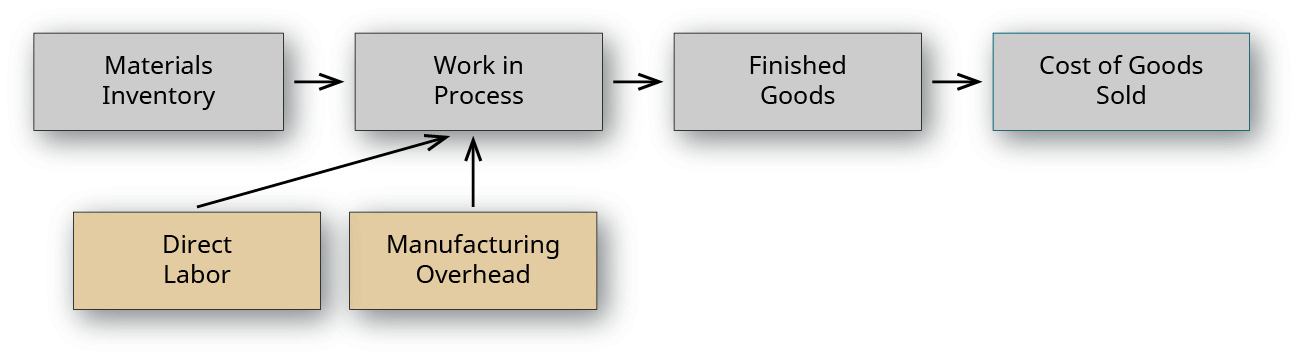

12000 direct material 2000 direct labor 100 indirect material 500 indirect labor 500 other costs 15100 total product cost. The answer is your target cost price. An average product cost per shirt of 103 is then determined by dividing the total annual product cost of 223 million by annual production of 21720 shirts.

The net realisable value per unit of product A is 48 selling price 60 less 12 further processing cost and of product B is 88 selling price 104 less 16 further processing cost. The cost of further processing. The amount of cost that goes into producing a product can directly impact its price and profit earned from each sale.

The company should charge an amount higher than 103 per piece of its shirts. Noteworthy theres a little. You then add your markup percentage lets say 50 retail industry standard to the total costs to give you a final product price of 5700 38 x 150.

When joint products can be identified separately. To find out the production cost per unit you will divide this total cost by the number of individual drinks manufactured. Learn techniques for ideating testing concepts and planning a successful launch.

Then calculate your target cost price cost of goods to maintain a 50 wholesale margin. Laker Company produces two products along with a single by-product. Below well take you through each important step of the development process.

For example slaughtering a cow joint process produces beef and leather joint products. 298 divided by 65 458. 27 Wholesale Price x 1 - 5 1350 Target Cost Price Dual pricing.

Subtract it from 1 to get the inverse. Then add the fixed costs and variable costs and divide the total cost by the number of items produced to get the average cost per unit. Consequently the cost component structure determines which costs you should consider in the cost component split.

Product Number of Units Produced Selling Price at Split-oft Selling Price after Processing Additional Processing Costs 12600 X 4500 1000 1500 Y 9000 1160 1620 18900 Z 3600 1940. 233 plus 065 per pound processing fee 298. Number of Units Produced.

Product Cost Planning CO-PC-PCP is an area within Product Cost Controlling CO-PC where you can plan costs for materials without reference to orders and set prices for materials and other cost accounting objects. So Company XYZ incurred total product costs of 15100 to produce 1000 tables or a unit product cost of 15100 1000 1510. The weight of the product you process times the price that you charge for it has to be greater than or equal to your cost of goods plus your overhead.

Process costing is a vital tool companies and production supervisors use to track product costs in industries that deal with mass amounts of produced goods and are subject to regular price fluctuations due to process and multiple production lines. This article has been a guide to what is Product Cost and its definition. We use the cost components for the analysis of the product cost in Product Costing and Profitability Analysis.

The cost of operating the joint process. Multiply 05 times the wholesale. If you remember our Charm Pricing tactic from the beginning you might mark this product at 5799.

Product A can be sold for 450000 after additional processing of 250000. Total product costs. Benson Company has 200 units of an obsolete part.

The best choice depends on your type of business what influences your customers to buy and the nature of your competition. Which of the following is NOT relevant in deciding whether to process a joint product beyond its split-off point. Cost component splits break down the cost of a material process or activity type.

The first stage of the product development process is focused on idea generation. The product development process in 5 stages. Selling Price at Split-off.

The next step is to determine the variable costs incurred in the production process. The by-product BP can be sold for 25000 after packaging costs of 5000. 1 - 05 05.

The price after additional processing. You will then arrive at the product cost per unit by dividing 500 by 240 to get 208. If one crate has 24 bottles and you have 10 crates then the total is 240 bottles.

458 divided by 75 611. Process costing results in a cost of goods manufactured COGM figure that is often listed on your. Selling Price after Processing.

Joint products are manufactured simultaneously in a joint process and share common inputs. Proper costs allocation for inventory costing and cost-of-goods-sold computations are important because. Cost-plus and value-based pricing.

To determine cost estimate of the productStandard price We can use this price for valuation of Inventory. Total Costs 38. The proportion of the process costs apportioned to If the question.

Describe And Identify The Three Major Components Of Product Costs Under Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Price Etsy Seller Product Price Worksheet Pricing Template Etsy Uk Small Business Plan Small Business Organization Small Business Inspiration

Comments

Post a Comment